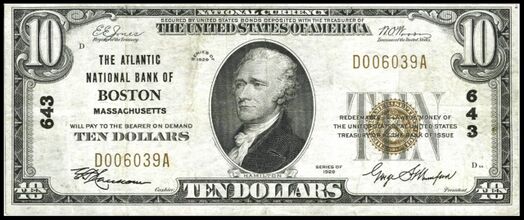

Atlantic NB/Fourth-Atlantic NB/Commonwealth-Atlantic NB/Atlantic NB, Boston, MA (Charter 643)

Atlantic NB/Fourth-Atlantic NB/Commonwealth-Atlantic NB/Atlantic NB, Boston, MA (Chartered 1864 - Liquidated 1932)

Town History

Boston is the capital and most populous city of the Commonwealth of Massachusetts and 24th-most populous city in the U.S. The city proper covers about 48.4 square miles with a population of 675,647 in 2020, also making it the most populous city in New England. It is the seat of Suffolk County (although the county government was disbanded on July 1, 1999). The city is the economic and cultural anchor of a substantially larger metropolitan area known as Greater Boston, a metropolitan statistical area (MSA) home to a census-estimated 4.8 million people in 2016 and ranking as the tenth-largest MSA in the country. A broader combined statistical area (CSA), generally corresponding to the commuting area and including Providence, Rhode Island, is home to some 8.2 million people, making it the sixth most populous in the United States.

Boston is one of the oldest municipalities in the United States, founded on the Shawmut Peninsula in 1630 by Puritan settlers from the English town of the same name. It was the scene of several key events of the American Revolution, such as the Boston Massacre, the Boston Tea Party, the Battle of Bunker Hill, and the siege of Boston. Upon American independence from Great Britain, the city continued to be an important port and manufacturing hub as well as a center for education and culture. The city has expanded beyond the original peninsula through land reclamation and municipal annexation. Its rich history attracts many tourists, with Faneuil Hall alone drawing more than 20 million visitors per year. Boston's many firsts include the United States' first public park (Boston Common, 1634), first public or state school (Boston Latin School, 1635), first subway system (Tremont Street subway, 1897), and first large public library (Boston Public Library, 1848).

Today, Boston is a thriving center of scientific research. The Boston area's many colleges and universities make it a world leader in higher education, including law, medicine, engineering and business, and the city is considered to be a global pioneer in innovation and entrepreneurship, with nearly 5,000 startups. Boston's economic base also includes finance, professional and business services, biotechnology, information technology and government activities.

Boston had 84 National Banks chartered during the Bank Note Era, and 75 of those banks issued National Bank Notes. Boston also had 63 Obsolete Banks that issued Obsolete Bank Notes during the Obsolete Bank Note Era (1782-1866).

Bank History

- Organized November 28, 1864

- Chartered December 24, 1864

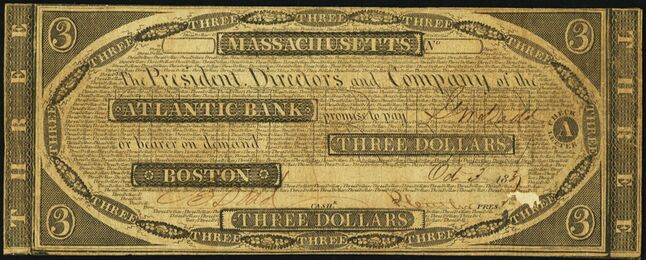

- Succeeded Atlantic Bank

- 1: Acquired 2289 The Metropolitan National Bank on July 15, 1909

- 1: Assumed 2277 by consolidation August 28, 1912 and its circulation (Fourth National Bank, Boston, MA)

- 1: Absorbed 595 October 2, 1922 (Peoples NB of Roxbury/Boston, Roxbury/Boston, MA)

- 3: Assumed 12377 by consolidation June 30, 1923 (Commonwealth NB (No Issue), Boston, MA)

- 3: Absorbed 545 July 26, 1923 (Boylston National Bank, Boston, MA)

- 4: Assumed 12862 by consolidation January 30, 1926 (Massachusetts NB (No Issue), Boston, MA)

- 4: Assumed 3923 by consolidation October 31, 1928 and its circulation (Commercial NB/Commercial Security NB, Boston, MA)

- 4: Assumed Beacon Trust Company July 31, 1930

- 4: Liquidated June 25, 1932

- 4: Absorbed by 200 (First National Bank of, Boston, MA)

The Massachusetts Legislature passed an act to incorporate the Atlantic Bank in March 1828. Benjamin Dodd, brother of James Dodd, for many years cashier of the Massachusetts Bank, and also of John Dodd, tobacco merchant began as a bookkeeper in the City Bank and afterwards held the position of foreign money clerk in the New England Bank. When the Atlantic Bank was established, Mr. Dodd was appointed cashier and he held that position until he died in 1875. In 1830, Pliny Cutler was chosen as president of the Atlantic Bank.

On October 1, 1855, stockholders of the Atlantic bank elected the following directors: Francis Fisher, Nathaniel Harris, Jeremiah Hill, Ezra C. Hutchins, John S. Jenness, Jas. H. Kelley, Abel G. Peck, W.R.P. Washburn. At a subsequent meeting of the directors, Nathaniel Harris, Esq., was chosen president.

In May 1868, the officers were Nathaniel Harris, president; Benjamin Dodd, cashier; George William Dodd, assistant cashier; and W.W. Cowles, notary public.[1]

On Tuesday, January 12, 1869, the following were re-elected directors: Abel G. Peck, John A. Dodd, Isaac Pratt, Jr., Henry Claflin, John E. Lyon, Edward G. Nickerson, Edwin A. Robinson, George W.A. Williams, and John Pearce.

In January 1873, the officers were Isaac Pratt, Jr., president; Benjamin Dodd, cashier; John Pierce, E.B. Phillips, Isaac Pratt, Jr., John A. Dodd, Henry Clafin, Edward A. Robinson, E.G. Nickerson, John C. Lyon, and T. Quincy Brown, directors.

In January 1874, the directors were Isaac Pratt, Jr., T. Quincy Browne, Henry Claflin, John A. Dodd, John E. Lyon, John Pearce, Edward A. Robinson, S.T. Snow, and Edward E. Rice.

On Tuesday, January 14, 1879, the directors were Henry Claflin, John A. Dodd, Edwin A. Robinson, Isaac Pratt, Jr. (President), John Pearce, T. Quincy Browne, Samuel T. Snow, Edward E. Rice and J. Thomas Vose.

In November 1891, the directors were Isaac Pratt, Jr., S.T. Snow, Edmund T. Pratt, William Read, T. Quincy Browne, Edward A. Abbot, James T. Drown, N. Willis Bumstead, and Oscar Howe. Isaac Pratt, Jr., was president and James T. Drown, cashier. The bank had capital of $750,000 and Surplus and profits of $330,000.

On Saturday, December 31, 1898, President T. Quincy Browne, formerly treasurer of the Assabet Manufacturing Co., whose notes he endorsed, resigned as president and made an assignment to Louis L. Browne and Walter S. Blanchard. It was believed that the Assabet Mills would come out all right. It was an up-to-date concern with $1,000,000 capital and a plant which cost $2,000,000 of which the second million was paid from earnings and written off. The company had $600,000 cash and bills receivable and $1,200,000 of goods on hand to meet its $1,500,000 liabilities. At a meeting of the directors, William B. Denison, formerly cashier, was elected president to succeed T. Quincy Browne, resigned. H.K. Hallett was elected assistant cashier.

On July 15, 1909, the Atlantic National bought the Metropolitan National Bank. The Metropolitan bank had a capital of $500,000, surplus and undivided profits of $310,651 and deposits of $1,411,283. The Atlantic had a capital of $750,000, surplus and undivided profits of $585,009 and deposits of $3,669,873. The directors of the Atlantic National were Willim G. Oeck, William Read, William B. Denison, George F. Putnam, H.K. Hallett, O.M. Wentworth, George H. Leonard, Isaac W. Chick and Edgar L. Rhodes. The directors of the Metropolitan were A.D. Hoitt, C.N. Breck, D.M. Anthony, I.E. Noyes, C.H. Adams, McIvah Larrabee, W.G. Sillaber, Walter H. Roberts, Frank W. Crocker, and A.W. Haines. President Increase E. Noyes and Cashier Haines were the only members of the Metropolitan board that would enter the Atlantic board, but the board was expected to expand to add more members from the Metropolitan.

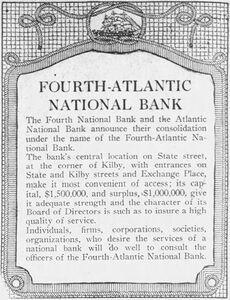

In April 1912, much speculation circulated in banking circles as to how the death of President A.W. Newell on the Titanic would affect the future of the Fourth National Bank. Rumors were that several Boston trust companies were anxious to put through a merger with the Fourth. However, the logical development would be an affiliation with the Atlantic National Bank which conducted a similar class of business and was located in the same district.

The afternoon of July 20, 1912, saw the Fourth National begin its move from its quarters in the Board of Trade Building to the new and much larger banking rooms in the Exchange Building in preparation for consolidation with the Atlantic National Bank of 75 State Street. Herbert K. Hallett, president of the Atlantic, would be president of the new consolidated bank. The merged bank would have total deposits of about $14 million. The capital of the Fourth was $1,000,000, its surplus and profits amounted to $900,000 and its deposits were $9 million. Although the president's office was vacant, the other officers were George W. Newhall, vice president; William N. Homer, cashier; Moses N. Arnold, Albert S. Eustis, Edwin Chapman, Charles H. Farnsworth, George S. Wright, Charles H. Moulton, Albert N. Parlin, William H. Conant, James S. Murphy, J.C.F. Slayton, Robert W. Williamson, Reuben Ring, Edward F. Woods, Jesse P. Lyman, Thomas Conningham, Geoffrey B. Lehy, and Frank L. Riplet, directors. The Atlantic had $750,000 capital paid in, surplus and undivided profits of about $700,000 and deposits of about $5,500,000. The officers were Herbert K. Hallett, president; William B. Denison, Arthur W. Haines, vice presidents; Nathan N. Denison, cashier; William Read, William G. Peck, O.M. Wentworth, William B. Denison, Herbert K. Hallett, Isaac W. Chick, Edgar L. Rhodes, Charles Henry Adams, C.H. Breck, W.H. Roberts, W.G. Shillaber, Increase E. Noyes, and Arthur W. Haines.

In March 1923, plans for a merger of the Fourth Atlantic National Bank and the Commonwealth Trust Company were concluded by interests connected with the two Institutions and special meetings of the respective boards of directors had been called to consider and act upon the question. It was provided that neither bank would assume control of the other or dominate the general policy, but that they would make an absolute and simple merger of all assets, good will officers, employees and business of the two institutions. Herbert K. Hallett, president of the Fourth Atlantic National Bank, would be chairman of the board, and George S. Mumford, president of the Commonwealth-Atlantic National Bank, the name it is proposed to give to the organization after the merger. Arthur P. Stone, vice president of the Commonwealth Trust Company, and William N. Homer, vice president of the Fourth Atlantic National Bank, together with the other present officers of the two banks, would continue with the same titles after the merger. In order to take advantage of the Federal statute relating to mergers, it was first necessary to convert the Commonwealth Trust Company into a National bank. After that was done and the Commonwealth Trust Company had become the Commonwealth National Bank, its merger with the Fourth-Atlantic National Bank would become a simple matter as soon as the stockholders of the two institutions agreed to the exchange of their stock share for share in the new organization. The Commonwealth-Atlantic National Bank would continue to occupy its present quarters as the main office and banking rooms in the Exchange Building, with entrances at 30 Congress Street and also at the corner of State and Kilby Streets. Upon completion of the new building in Post Office Square, east side, the entire street floor would be taken possession of and occupied as the main office of the bank, with safe deposit vaults in the basement and the present banking rooms at Kilby Street and 30 Congress Street would be given up. All the branch offices of both institutions would continue as offices of the new bank. The Commonwealth-Atlantic National Bank would have capital and surplus in excess of $8,000,000, and deposits of $70,000,000 and total resources of $80,000,000.

In December 1925, National Union Bank was absorbed by State Street Trust while Massachusetts Trust Company was changed to Massachusetts National Bank, chartered December 19th, this in turn was absorbed by Atlantic National Bank in February 1926. In December 1913, the incorporators changed the name from Industrial Trust Company to the Massachusetts Trust Company, made possible through the courtesy of the Old Colony Trust Company which acquired the right to employ the name "Massachusetts" by its absorption of the Massachusetts Loan and Trust Company. The officers of the new trust company were Edgar R. Champlin, president; Charles D. Buckner, treasurer; State Treasurer Elmer A. Stevens, whose five years' incumbency of office expired in a month, vice president.

The Massachusetts Trust Co. was charted in 1914 and opened in the old Eliot National's quarters in the John Hancock Building on February 10, 1914.

Tue., Dec. 30, 1913. Boston Evening Transcript, Sat., Jan. 10, 1914. In mid-November 1925, negotiations were practically complete for the merger of the Massachusetts Trust Company with the Atlantic National Bank. Executive committees of both institutions first approved the terms of consolidation and late Friday, November 13th, the full boards of both institutions ratified the proposition. With $22 million in deposits in the Massachusetts Trust Co., the consolidated Atlantic National would have deposits exceeding $110,000,000, making it the third largest bank in New England. Also, with the trust company's uptown branch on Huntington Avenue and the Haymarket branch on Canal Street, it would have seven branches. No change would be made in the personnel of the Massachusetts Trust Co., and a number of directors would be added to the board of the Atlantic. Gen. Edgar R. Champlin, president of the Massachusetts Trust Co., would become vice chairman of the board. As of September 28, the Massachusetts Trust Co. had capital of $1,000,000, surplus $500,000, undivided profits $903,247, deposits $12,427,000 and resources of $24,844,000. As of the same date, the Atlantic National had capital of $5,000,000, surplus and undivided profits $3,761,868, deposits $86,622,000 and resources of $104,131,000.

On January 2, 1930, the Atlantic National Bank opened a new branch at 144 Tremont Street between West Street and Temple Place. The bank's aim was to serve women particularly through this branch and its location was in the shopping district of Boston. The personnel of the bank included men especially selected to care for the business of women customers and special rooms were set aside for their accommodation. The manager of the new office was Roger F. Nichols. The new Mark Cross Building at 144 and 145 Tremont Street was erected by the Atlantic National Bank from plans by Shepard & Stearns with W.M. Evatt Company, builders. The Mark Cross Company controlled the entire building with the exception of a portion of the ground floor occupied by the Atlantic as its retail section branch.

On July 16, 1930, stockholders of the Atlantic National Bank approved the plan to absorb the Beacon Trust Company and increase capital stock from $8,000,000 to $9,875,000 of $25 par. Stockholders of Beacon Trust Company also approved the plan to consolidate on the basis of one share of Atlantic for two shares of Beacon. Beacon Trust operated a banking house at 31 Milk Street, Boston.

In January 1932, at the annual stockholders' meeting the following directors were elected: Charles W. Bailey, Hugh Bancroft, William L. Barrell, Junius Beebe, William C. Chick, Charles F. Cutler, George L. DeBlos, Charles H. Farnsworth, Lee M. Friedman, Herbert E. Gale, Albert E. Gladwin, Robert H. Gross, James R. Haigh, Arthur W. Haines, Samuel R. Haines, Herbert K. Hallett, Henry I. Harriman, William P. Art, Fred A. Howland, Benjamin N. Johnson, George B. Johnson, Charles B. Jopp, Frank B. Lawler, Arthur T. Lyman, W.J. McDonald, George S. Mumford, James S. Murphy, Harry K. Noyes, John E. Olham, Edward H. Osgood, Rene E. Paine, Garner Poole, Edgar L. Rhodes, Fred B. Rice, John Richardson, Arthur P. Stone, Allan H. Sturges, George W. Treat, George B. Watson, Lester Watson, Edwin S. Webster, Arthur W. Wellington, V.C. Bruce Wetmore, Edward F. Woods, Edgar N. Wrightington.

On February 15, 1932, stockholders approved a plan to reduce the par value of its shares to 410 and to increase capital stock by issuing 500,000 new shares at $20 per share or an aggregate of $10,000,000. Shareholders were given the right to subscribe to new stock at $20 per share. Each shareholder was entitled to 1 1/4 new shares for each share owned. A group of Boston Clearing House banks agreed to lend money to the Post Office Square Securities Corp., formerly the Atlantic Corporation of Boston, to be used to purchase half of the new stock at $20 per share.

On March 18, 1932, at a meeting of the directors, Herbert K. Hallett resigned as chairman of the board and George S. Mumford as president. To succeed them, Harry K. Noyes was elected chairman of the board and James D. Brennan, president. Mr. Noyes, president of the Noyes Buick Co., was one of the leaders of the automobile industry in New England. He had been a director for 18 years and was a substantial stockholder. Mr. Brennan was formerly chief national bank examiner for the First Federal Reserve District and for some years a vice president of the First National Bank of Boston.

Swampscott, Mass., April 8, 1932. James D. Brennan, president of the Atlantic National Bank of Boston, died at his home here today after an illness of several weeks. He was 51 years old and a native of Huntington, Vermont. He began his banking career with the Boston Trust Company and later served as a state bank examiner and as chief National Bank examiner for the First Federal Reserve District. He was a vice president of the First National Bank of Boston. Brennan was a director of the Morris Plan Company and a trustee of the Franklin Savings Bank. He was a graduate of Vermont University and vice president of the University Club. He was married to the former Edith Poor of Andover who survived him.

Frank C. Nichols was elected president of the Atlantic National to succeed Mr. Brennan. He most recently had been a member of the Finance Commission of Fall River and prior to that was active for a dozen or more years with local banking institutions.

On May 4, 1932, the First National Bank of Boston absorbed the Atlantic National Bank and the various offices of the Atlantic National would remain open to transact business for the present. The deposits of the Atlantic National by the absorption were guaranteed by the First National Bank which it was expected would bring to a close what had been termed "insidious" rumors going on for some time. Deposit liabilities amounted to $65 million which were met with cash and reserves of $122 million along with $300 million in Government securities and other quick assets of the First National. The First National planned to liquidate the assets of the Atlantic National which was expected to take a matter of two years. The feeling was that return to Atlantic stockholders would be substantial. Frank C. Nichols who was recently elected president of the Atlantic National with Chairman Noyes was largely instrumental in developing the absorption and would become a vice president of the First National Bank. Mr. Nichols stated, "In assuming the presidency of the Atlantic National Bank, I did so with confidence as to its solvency and as to its future possibilities. Owing to the unusual withdrawals which have occurred during the last few days, the management came to the conclusion that the interest of the depositors would be best served through the arrangement which has been made with the First National Bank of Boston under which the deposits of the Atlantic National Bank will be assumed by that institution. I have been asked to become a vice president of the First National Bank of Boston and am very glad to do so." The absorption of the Atlantic National was a case where a solvent institution was taken over by another strong bank in order to fortify the general position of the banks. There seemed no end to the rumors that had been gaining circulation and to terminate them the consolidation was deemed the most advisable step possible.

Waldron H. Rand, Jr., president, would carry out the liquidation of the Atlantic National Bank along with Edward G. Boyle, cashier.

Official Bank Title(s)

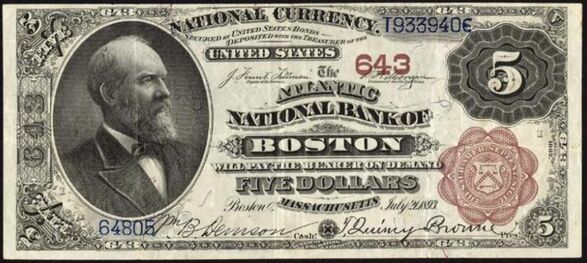

1: The Atlantic National Bank of Boston, MA

2: The Fourth-Atlantic National Bank of Boston, MA (8/30/1912)

3: The Commonwealth-Atlantic National Bank of Boston, MA (6/30/1923)

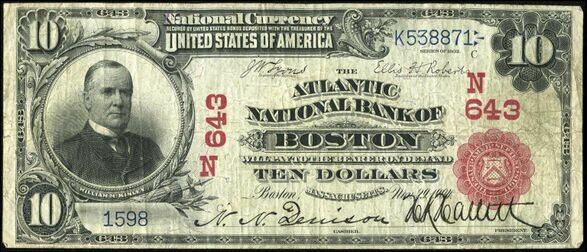

4: The Atlantic National Bank of Boston, MA (8/8/1924)

Bank Note Types Issued

A total of $17,304,430 in National Bank Notes was issued by this bank between 1864 and 1932. This consisted of a total of 2,118,722 notes (1,950,890 large size and 167,832 small size notes).

This bank issued the following Types and Denominations of bank notes:

Series/Type Sheet/Denoms Serial#s Sheet Comments 1: Original Series 3x1-2 1 - 3000 1: Original Series 4x5 1 - 20750 1: Original Series 3x10-20 1 - 9100 1: Original Series 50-100 1 - 567 1: Original Series 500 1 - 100 1: Series 1875 3x1-2 1 - 2000 1: Series 1875 4x5 1 - 14000 1: Series 1875 3x10-20 1 - 7700 1: Series 1875 50-100 1 - 1000 1: Series 1875 500 1 - 100 1: 1882 Brown Back 4x5 1 - 74487 1: 1882 Brown Back 3x10-20 1 - 24718 1: 1882 Brown Back 50-100 1 - 500 1: 1902 Red Seal 4x5 1 - 12000 1: 1902 Red Seal 3x10-20 1 - 9800 1: 1902 Date Back 4x5 1 - 11135 1: 1902 Date Back 3x10-20 1 - 7796 2: 1902 Date Back 4x5 1 - 62500 2: 1902 Date Back 3x10-20 1 - 50000 2: 1902 Date Back 3x50-100 1 - 4200 2: 1902 Plain Back 4x5 62501 - 120500 2: 1902 Plain Back 3x10-20 50001 - 84000 3: 1902 Plain Back 4x5 1 - 40000 3: 1902 Plain Back 3x10-20 1 - 23000 4: 1902 Plain Back 4x5 1 - 9807 4: 1902 Plain Back 4x10 1 - 8646 4: 1929 Type 1 6x5 1 - 18802 4: 1929 Type 1 6x10 1 - 9170

Bank Presidents and Cashiers

Bank Presidents and Cashiers during the National Bank Note Era (1864 - 1932):

Presidents:

- Nathaniel Harris, 1865-1868

- Isaac Pratt, Jr., 1869-1896

- Thomas Quincy Browne (Sr.), 1897-1898

- William B. Denison, 1899-1903

- Herbert K. Hallett, 1904-1922

- George Saltonstall Mumford, 1923-1931

- James Dowd Brennan, 1932

Cashiers:

- Benjamin Dodd, 1865-1874

- James Tufts Drown, 1875-1897

- William B. Denison, 1898-1898

- Herbert K. Hallett, 1899-1903

- Nathan N. Denison, 1904-1911

- William Nichols Homer, 1912-1924

- Edgar F. Hanscom, 1925-1932

Other Bank Note Signers

- There are currently no known Vice President or Assistant Cashier bank note signers for this bank.

Wiki Links

- Massachusetts Bank Note History

- General information on Boston (Wikipedia)

- General information on Suffolk County (Wikipedia)

- General information on Massachusetts (Wikipedia)

Sources

- Boston, MA, on Wikipedia

- Don C. Kelly, National Bank Notes, A Guide with Prices. 6th Edition (Oxford, OH: The Paper Money Institute, 2008).

- Dean Oakes and John Hickman, Standard Catalog of National Bank Notes. 2nd Edition (Iola, WI: Krause Publications, 1990).

- Banks & Bankers Historical Database (1782-1935), https://spmc.org/bank-note-history-project

- The Pittsfield Sun, Pittsfield, MA, Thu., Mar 27, 1828.

- The Horn of the Green Mountains, Manchester, VT, Tue., June 8, 1830.

- Boston Evening transcript, Boston, MA, Mon., Oct. 1, 1855.

- Boston Evening Transcript, Boston, MA, Tue., Jan. 12, 1869.

- The Boston Globe, Boston, MA, Wed., Jan. 15, 1873.

- Boston Evening Transcript, Boston, MA, Wed., Jan. 14, 1874.

- Boston Post, Boston, MA, Wed., Jan. 15, 1879.

- Boston Evening Transcript, Boston, MA, Fri., Nov. 6, 1891.

- The Boston Globe, Boston, MA, Tue., Jan., 3, 1899.

- The Boston Globe, Boston, MA, Thu., Jan. 5, 1899.

- The Boston Globe, Boston, MA, Thu., July 15, 1909.

- Boston Evening Transcript, Boston, MA, Sat., Apr. 27, 1912.

- Boston Evening Transcript, Boston, MA, Sat., July 20, 1912.

- The Boston Globe, Boston, MA, Mon., Sep. 16, 1912.

- The Boston Globe, Boston, MA, Wed., Oct. 2, 1912.

- The Boston Globe, Boston, MA, Tue., Mar. 27, 1923.

- The Boston Globe, Boston, MA, Sat., Nov. 14, 1925.

- The Boston Globe, Boston, MA, Mon., Mar. 29, 1926.

- The Boston Globe, Boston, MA, Thu., Jan. 2, 1930.

- The Boston Globe, Boston, MA, Wed., Jan. 8, 1930.

- The Boston Globe, Boston, MA, Wed., July 16, 1930.

- The Boston Globe, Boston, MA, Thu., July 17, 1930.

- The Boston Globe, Boston, MA, Tue., Jan. 12, 1932.

- The Boston Globe, Boston, MA, Tue., Feb. 16, 1932.

- Burlington Daily News, Burlington, VT, Fri, Apr. 8, 1932.

- The Boston Globe, Boston, MA, Tue., May 3, 1932.

- The Boston Globe, Boston, MA, Wed., May 4, 1932.

- ↑ The Bankers' Magazine, Vol. 22, July 1867-June 1868, p. 978.