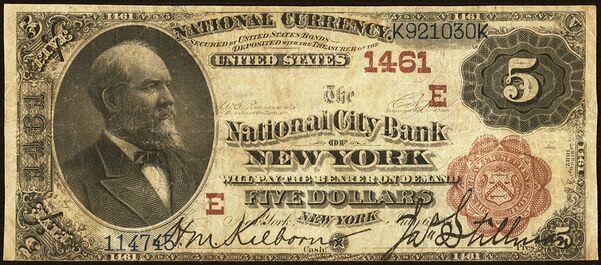

National City Bank, New York, NY (Charter 1461)

National City Bank, New York, NY (Chartered 1865 - Open past 1935)

Town History

New York, often called New York City or NYC, is the most populous city in the United States. With a 2020 population of 8,804,190 distributed over 300.46 square miles, New York City is the most densely populated major city in the United States. The city is more than twice as populous as Los Angeles, the nation's second-largest city. New York City is located at the southern tip of New York State. Situated on one of the world's largest natural harbors, New York City comprises five boroughs, each of which is coextensive with a respective county. The five boroughs, which were created in 1898 when local governments were consolidated into a single municipality, are: Brooklyn (Kings County), Queens (Queens County), Manhattan (New York County), the Bronx (Bronx County), and Staten Island (Richmond County). New York City is a global city and a cultural, financial, high-tech, entertainment, glamour, and media center with a significant influence on commerce, health care and scientific output in life sciences, research, technology, education, politics, tourism, dining, art, fashion, and sports. Home to the headquarters of the United Nations, New York is an important center for international diplomacy, and it is sometimes described as the world's most important city and the capital of the world.

New York had 180 National Banks chartered during the Bank Note Era, and 143 of those banks issued National Bank Notes.

Bank History

- Organized July 5, 1865

- Chartered July 17, 1865

- Succeeded City Bank of New York

- Assumed 87 by consolidation May 20, 1897 (Third NB of the City of, New York, NY)

- Assumed 11965 by consolidation June 14, 1921 (Commercial Exchange NB (No Issue), New York, NY)

- Absorbed 62 (old 2668) December 31, 1921 and its circulation (Second NB of the City of, New York, NY)

- Assumed 12932 by consolidation June 26, 1926 (Peoples TC of Brooklyn NBA (No Issue), New York, NY)

- Assumed The Farmers Loan State Bank, New York, June 29, 1929

- Absorbed 12885 May 29, 1931 (Long Island National Bank, New York, NY)

- Absorbed 13193 November 28, 1931 (Bank of America NA, New York, NY)

- Bank was Open past 1935

- For Bank History after 1935 see FDIC Bank History website

- Changed Institution Name to Citibank, N.A. on March 1, 1976

- Maintained operations with government assistance (2008)

- Still in business as Citibank, N.A. (March 2024)

City Bank of New York

The City Bank of New York was founded on June 16, 1812, occupying the old United States Bank Building. The first president of the City Bank was the statesman and retired Colonel, Samuel Osgood. After Osgood's death in August 1813, William Few became President of the bank, staying until 1817, followed by Peter Stagg (1817–1825), Thomas Smith (1825–1827), Isaac Wright (1827–1832), and Thomas Bloodgood (1832–1843). After the Panic of 1837, Moses Taylor acquired control of the company. Under Taylor, the bank functioned largely as a treasury and finance center for Taylor's own extensive business empire. Later presidents of the bank included Gorham A. Worth (1843–1856), Moses Taylor himself (1856–1882), Taylor's son-in-law Percy Rivington Pyne (I), and James Stillman (1891–1909).

In 1831, City Bank was the site of one of America's first bank heists when two thieves made off with tens of thousands of dollars' worth of bank notes, and 398 gold doubloons.

The bank financed war bonds for the War of 1812, serving as a founding member of the financial clearinghouse in New York (1853), underwriting the Union during the American Civil War with $50 million in war bonds, opening the first foreign exchange department of any bank (1897), and receiving a $5 million deposit to be given to Spain for the US acquisition of the Philippines (1899).

National City Bank of New York

In 1868 the directors were Moses Taylor, John J. Cisco, Tarrant Putnam, George Greer, Louis A. Von Hoffman, John Alstyne, Henry Paris, John J. Phelps, and Samuel Sloan. Moses Taylor was president and Benjamin Cartwright, cashier. Capital was $1,000,000.[1]

On May 20, 1897, the consolidation of the Third National Bank at 26 Nassau Street and the National City Bank at 52 Wall Street was effected, the Third passing from existence through liquidation. Under its president, A. Barton Hepburn, ex-Comptroller of the Currency, the Third had prospered. He would be a vice president of the National City Bank. Secret negotiations had begun in April and were ratified by the boards of each banking house after banking hours. Mr. James Stillman said,

"The gentlemen interested in the Third National Bank were anxious to effect a consolidation of their business with that of the National City Bank. The consolidation ensures to us the addition of a very large amount of valuable business which of course is always desirable. The volume of business done by a bank having a large line of deposits may be very greatly increased without much addition to the labor of managing it. Our object was two-fold: first, to secure the business of the Third National; and second, that we might have Mr. Hepburn associated with us in the management of our bank."

Notices were mailed to depositors of the Third National. They would have the services of a bank with practically $5,000,000 capital in exchange for a bank with $1,000,000 capital. The Third National, established in 1863, had the following officers: A. Barton Hepburn, president; Henry Chapin, Jr., cashier; Walter H. Tappan, notary. Among its directors were Charles S. Fairchild, George H. Church, Hugh Kelly, John B. Woodward, James H. Post, William V.S. Thorne, and W.H. Wickham. The National City Bank was organized in 1812 and it first did business on the site it then occupied which was the old United States Bank Building. It's officers were James Stillman, president; Gilson S. Whitson, cashier; H.M. Kilborn, notary. Its principal directors were Samuel Sloan, Lawrence Turnure, Rosewell G. Rolston, Cleveland H. Dodge, William Rockefeller, H. Walter Webb, Francis M. Bacon, M. Taylor Pyne, and Robert Bacon.[2]

On Tuesday, January 8, 1901, the stockholders re-elected the same board. Directors elected Cashier G.S. Whitson to be vice president; W.A. Simonson, assistant cashier, to be vice president; H.M. Kilborn, assistant cashier to be cashier. This gave the institution the distinction of being the only bank in the city to have four vice presidents, the others were Samuel Sloan and A.G. Loomis.[3]

In 1908, the National City Bank moved into 55 Wall Street. Formerly the National City Bank Building, 55 Wall Street was an eight-story building on Wall Street between William and Hanover Streets in the Financial District of Lower Manhattan in New York City. The lowest three stories were completed in either 1841 or 1842 as the four-story Merchants' Exchange and designed by Isaiah Rogers in the Greek Revival style. Between 1907 and 1910, McKim, Mead & White removed the original fourth story and added five floors to create the present building. After 55 Wall Street was expanded, it served as the headquarters of National City Bank from 1908 to 1961. The National City Bank's new home opposite the old quarters at 52 Wall Street opened with much publicity. The architects, Messrs. McKim, Mead & White were successful in preserving the lines and character of the old building although they more than doubled its capacity. The old granite walls with the Ionic colonnade on Wall Street were left almost unchanged although the interior was entirely removed and the floor level lowered to meet the street level. On the shoulders of this old structure were superimposed four stories and a roof floor, a Corinthian colonnade was placed above the old Ionic monoliths. The bank occupied all of the lower section and the four floors above would be rented. These floors were built surrounding an interior court or light well at the bottom of which was the huge glass dome lighting the main banking chamber. The banking room contained 25,000 square feet. It was finished in soft warm gray Italian marble and the floor was a smooth French stone of a similar tone. The ceiling and dome base were likewise without color. The only color was from the heavy bronze grills and chandeliers and the dark, rich mahogany furniture. The president's offices were located in the Hanover and Exchange Place corner and above was located the directors' room. James A. Stillman, a son of James Stillman, was one of the vice presidents. Other vice presidents were William A. Simonson, Horace M. Kilborn, and John E. Gardin. Arthur Kavanaugh was cashier and the assistant cashiers were W.H. Tappan, S.E. Albeck, J.H. McEldowney, G.E. Gregory, A.H. Titus, and William Reed. When the bank had safely settled into its now quarters, the officials and others got together and presented testimonials to Vice President Hoarace M. Kilborn and Assistant Cashier G.E. Gregory as a recognition of their services in planning many of the details of the new building and in carrying out the program of removal.[4]

In December 1917, the German Exchange Bank of the City of New York petitioned the state Supreme Court to change its name to the "Commercial Exchange Bank."[5] Joseph M. Adrian was president and George Kern, cashier. The bank had capital of $200,000 and deposits of approximately $6 million. The directors were Joseph M. Adrian, George M. Adrian, Louis A. Fahs, Joseph Frey, Henry A. Petersen, Thomas Rothmann, Carl G. Amend, Louis Haupt, and Carl Amend.[6]

In April 1921, application to convert the Commercial Exchange Bank of New York into the Commercial National Bank with $700,000 capital was forwarded to the comptroller of the currency. That action was the first step towards the merger of the institution with the National City Bank expected around June 1st.[7] On June 13, 1921, directors of the National City Bank approved the plan for merging the Commercial Exchange National Bank under the City Bank's charter. The Commercial Exchange National Bank was a conversion of The Commercial Exchange Bank of New York with its 3 branches to a national bank to allow its absorption by National City Bank. City National would operate the branches located at 330 Bowery, Broadway and 26th Street, and Vanderbilt Avenue and 43rd Street in the Biltmore Hotel. The Commercial Exchange Bank had capital, surplus and undivided profits of $1,600,000 and about $8 million in deposits.[8] Louis A. Fahs was president, G.M. Adrian and L.J. Adrian vice presidents; and George Kern, cashier. The National City Bank was the first of the large Wall Street banks to acquire an uptown branch, although several other institutions including the Chatham and Phoenix, the Irving National, and the Mechanics and Metals National had branches in other parts of the city.[9]

In November 1921, Charles E. Mitchell, president of the National City Bank, announced the institution had purchased a large majority of the stock of the Second National Bank, that the branch at 26th Street and Broadway would be transferred to 250 Fifth Avenue, and that the two would become a single unit in the National City Bank's system of branches. The plan was to strengthen the position of National City in the Madison Square district. Reportedly, control of Second National had been by the William Rockefeller and the James Stillman estate. The Second National served a large textile trade and owned the building in which it was located. W.A. Simonson, a vice president of the National City Bank, was the president. The Second National was organized in 1863 and according to its last statement had capital of $1,000,000, surplus and undivided profits $4,841,800; loans $22,435,000, and deposits $17,205,000. The merger would give National City Bank more the $530 million in deposits.[10]

In March 1926, the National City Bank of New York bought the Peoples Trust Company of Brooklyn in a $16,700,000 deal, paying approximately $835 a share. The Peoples Trust Company of Brooklyn operated a main office on Montague Street and 10 branch offices in various sections of the borough. This would be the biggest bank merger accomplished with a Brooklyn institution and marked entry into this borough of the most powerful bank in the United States. Charles E. Mitchell was president of National City Bank with total resources of $1,291,000,000 and just under a billion dollars in deposits. A national bank was not permitted to operate branches, but could maintain separate offices under the law that permitted "tellers windows" in various locations. The National City Bank made it clear that there would be no change in personnel of the Brooklyn offices and those would soon carry the name of the New York institution. In order to effect this merger, the Peoples Trust Company of Brooklyn would convert to the Peoples Trust Company of Brooklyn, National Association under a national charter.[11]

Charles L. Schenk, vice president of the Peoples Trust, who was designated as acting president after the death of Charles A. Boody about a month earlier, would remain in charge. A merger was reported with the Brooklyn Trust Co., next door neighbor to the Peoples Trust in Montague Street, but the National City Bank became the stronger bidder.[12] The Peoples Trust Company of Brooklyn was organized in 1889, capital $500,000 and surplus $250,000, with William H. Murtha being the first president. It moved into its handsome new building on Montague Street in Brooklyn's financial district on Monday, March 26, 1906.[13]

In June 1929, at a special meeting, stockholders ratified the merger of the National City and Farmers Loan State Bank which was expected to bring the total resources above $2 billion. The Farmers Loan State Bank represented a segregation of the commercial banking business of the Farmers Loan and Trust Co., the trust business of which would be acquired by the City Bank Farmers Trust Co., another subsidiary of the National City Bank.[14] Stockholders of City Bank Farmers Trust Co. and of Farmers Loan & Trust Co. in simultaneous meetings approved the merger under the charter of Farmers Loan and Trust Co. and title of City Bank Farmers Trust Co. The banking business of Farmers Loan & Trust was transferred to Farmers Loan State Bank which merged into National City Bank. Thus, City Bank Farmers Trust Co. would do purely a trust company business, leaving the banking business to National City.[15]

At the close of 1930, the Long Island National Bank reported capital stock $250,000, surplus and undivided profits 25,120.41, deposits of over $2.5 million, and total resources of $3,287,516.83.[16] The bank was scheduled to be reorganized at a meeting of the shareholders on Tuesday, February 10th, 1931, by William J. Large, president. Many of the bank's former officers and directors were awaiting sentence or trial on charges of misappropriating the institution's funds and making false reports on the bank's financial condition.[17] Albert R. Allen and Edward F. Wagner, former vice presidents of the Long Island National Bank of Astoria, helped the Government to convict their associates in the bank and were expecting to receive suspended sentences for their services. Those convicted associates were William H. Siebrecht, Jr., former president and seven former directors of the bank. They were found guilty of conspiracy to defraud the bank of some $40,000 in realty transactions with the bank's funds and all were given jail sentences. Jointly indicted with the convicted men, Allen and Wagner pleaded guilty prior to trial. They were scheduled for trial on the conspiracy indictment on February 4th. Lawyers for the two called upon the Attorney General in Washington to nol pros. the case as a matter of equity.[18]

On February 10, 1931, the only woman bank director in Queens was elected by shareholders of the Long Island National Bank of Astoria. Mrs. Agnes Sikora Gilligan, an attorney, a builder, and a mother was one of the eight directors elected, marking the final step in the reorganization. Mrs. Gilligan was a daughter of the late Ludwig Sikora, a pioneer in the development of Long Island residential property, and the wife of William Gilligan, an attorney. The Gilligan home was on 29th Street, Astoria. The other directors elected were James Prowse, Sr., Morris Manacher, Richard C. Foelsch, Michael Roth, John R. Gerstner, Wemyss G. Mowatt, Valentine Schiller, Harry R. Gelwicks. Moses Symington of Astoria was elected vice president of the bank.[19] On April 23, 1931, the National City Bank absorbed the Long Island National Bank of Astoria. However, minority stockholders sought to delay the deal with Michael Jorio, temporary chairman of a dozen of the stockholders of the Astoria bank, initiating the movement. The absorption of the bank was on a liquidation basis which protected depositors, however, no residual equity would remain for stockholders who invested in the bank. In addition, no dividends were ever paid to stockholders.[20]

In February 1933, Wagner and Allen were each fined $5,000 when they pleaded guilty to a charge of making a false report. William H. Siebrecht, Jr. also was fined $5,000 after pleading guilty to a false report to the comptroller of the currency. His conviction 3 years earlier was over-turned and thus he avoided prison.[21]

In March 1955, plans were announced to merge National City Bank of New York, second largest bank in the U.S. with the First National Bank of New York, the 35th ranking bank. The merged institution would be called the First National City Bank and would have assets close to $7.04 billion.[22] Under the agreement National City would pay $550 a share, cash, to stockholders of First National for a total of $165 million for the 300,000 shares outstanding. The merged institution would have 73 branches in greater New York and 59 branches overseas.[23]

In January 1962, stockholders approved a new official title: First National City Bank. The bank, third largest commercial bank in the nation had not been using the "the" and "of New York" for about a year, but the words remained in the legal name.[24] Comptroller of the Currency, James J. Saxon blocked the merger of the First National City Bank with the National Bank of Westchester.[25] The Westchester bank would years later merge with Chase Manhattan Bank.

Official Bank Title

1: The National City Bank of New York, NY

Bank Note Types Issued

A total of $128,317,840 in National Bank Notes was issued by this bank between 1865 and 1935. This consisted of a total of 13,687,753 notes (8,737,492 large size and 4,950,261 small size notes).

This bank issued the following Types and Denominations of bank notes:

Series/Type Sheet/Denoms Serial#s Sheet Comments Original Series 4x5 1 - 3400 All Original Series notes returned - No Circulation. Original Series 3x10-20 1 - 500 All Original Series notes returned - No Circulation. Original Series 50-100 1 - 600 All Original Series notes returned - No Circulation. Original Series 500-1000 1 - 100 All Original Series notes returned - No Circulation. 1882 Brown Back 4x5 1 - 140000 1882 Brown Back 3x10-20 1 - 386000 Abnormal Border Variety for the ABC and DEF $10 plates; the D plate $20 was re-entered with a Variety 1 roll over Variety 3

1902 Red Seal 4x5 1 - 270840 1902 Red Seal 4x10 1 - 134165 Plates PQRS, TUVW, and AABBCCDD 1902 Red Seal 3x10-20 1 - 293332 1902 Date Back 4x5 1 - 472449 1902 Date Back 4x10 1 - 202000 1902 Date Back 3x10-20 1 - 245337 1902 Date Back 3x50-100 1 - 36000 1929 Type 1 6x5 1 - 368630 324078 Not issued 1929 Type 1 6x10 1 - 235258 1929 Type 1 6x20 1 - 86872 1929 Type 2 5 1 - 563920 1929 Type 2 10 1 - 161532 1929 Type 2 20 1 - 80255

Bank Presidents and Cashiers

Bank Presidents and Cashiers during the National Bank Note Era (1865 - 1935):

Presidents:

- Moses Taylor, 1865-1881

- Percy Rivington Pyne Sr., 1882-1891

- James Jewett Stillman, 1892-1908

- Frank Arthur Vanderlip Sr., 1909-1918

- James Alexander Stillman, 1919-1920

- Charles Edwin Mitchell, 1921-1928

- Gordon Sohn Rentschler, 1929-1935

Cashiers:

- Benjamin Cartwright, 1865-1876

- David Palmer, 1877-1892

- George Dedman Meeker, 1893-1896

- Gilson Suydam Whitson, 1897-1900

- Horace Middlebrook Kilborn, 1901-1905

- Arthur Kavanagh, 1906-1913

- George Edwin Gregory, 1914-1916

- Thomas A. Reynolds, 1917-1917

- Walter House Tappan, 1918-1919

- Nathan Coggeshall Lenfestey, 1920-1935

Other Known Bank Note Signers

Bank Note History Links

Sources

- New York, NY, on Wikipedia

- Don C. Kelly, National Bank Notes, A Guide with Prices. 6th Edition (Oxford, OH: The Paper Money Institute, 2008).

- Dean Oakes and John Hickman, Standard Catalog of National Bank Notes. 2nd Edition (Iola, WI: Krause Publications, 1990).

- Banks & Bankers Historical Database (1782-1935), https://spmc.org/bank-note-history-project

- ↑ The Bankers' Magazine, Vol. 22, July 1867-June 1868, p. 958.

- ↑ The New York Times, New York, NY, Fri., May 21, 1897.

- ↑ The New York Times, New York, NY, Wed., Jan. 9, 1901.

- ↑ The Bankers' Magazine, Vol. 78, Jan. 1909-June 1909, pp 459-464.

- ↑ New-York Tribune, New York, NY, Fri., Jan. 4, 1918.

- ↑ The New York Times, New York, NY, Wed., Jan. 9, 1918.

- ↑ New York Herald, New York, NY, Sat., Apr. 16, 1921.

- ↑ New York Herald, New York, NY, Tue., June 14, 1921.

- ↑ New-York Tribune, New York, NY, Wed., Mar. 9, 1921.

- ↑ New York Herald, New York, NY, Wed., Nov. 23, 1921.

- ↑ Times Union, Brooklyn, NY, Thu., Mar. 4, 1926.

- ↑ Times Union, Brooklyn, NY, Thu., Mar. 4, 1926.

- ↑ The Bankers' Magazine, Vol. 72, Jan. 1906-June 1906, pp 581-4.

- ↑ The Brooklyn Daily Eagle, Brooklyn, NY, Fri., June 28, 1929.

- ↑ Times Union, Brooklyn, NY, Fri., June 28, 1929.

- ↑ Times Union, Brooklyn, NY, Fri., Jan. 9, 1931.

- ↑ The Standard Union, Brooklyn, NY, Tue., Jan. 20, 1931.

- ↑ The Brooklyn Daily Eagle, Brooklyn, NY, Sun., Feb. 1, 1931.

- ↑ The Standard Union, Brooklyn, NY, Tue., Feb. 10, 1931.

- ↑ The Brooklyn Daily Eagle, Brooklyn, NY, Fri., Apr. 24, 1931.

- ↑ The Brooklyn Daily Eagle, Brooklyn, NY, Sun., Feb. 26, 1933.

- ↑ Daily News, New York, NY, Wed., Mar. 2, 1955.

- ↑ Daily News, New York, NY, Wed., Oct. 5, 1955.

- ↑ The Daily Times, Mamaroneck, NY, Wed., Jan. 17, 1962.

- ↑ Newsday (Suffolk Edition), Melville, NY, Mon., Jan. 8, 1962.

- ↑ The Bankers' Magazine, Vol. 98, Jan. 1919-June 1919, p. 58.